Banking

AI-POWERED DOCUMENT INTELLIGENCE FOR FINANCE & BANKING

Base64 automates complex document processing with ease

Built for banking

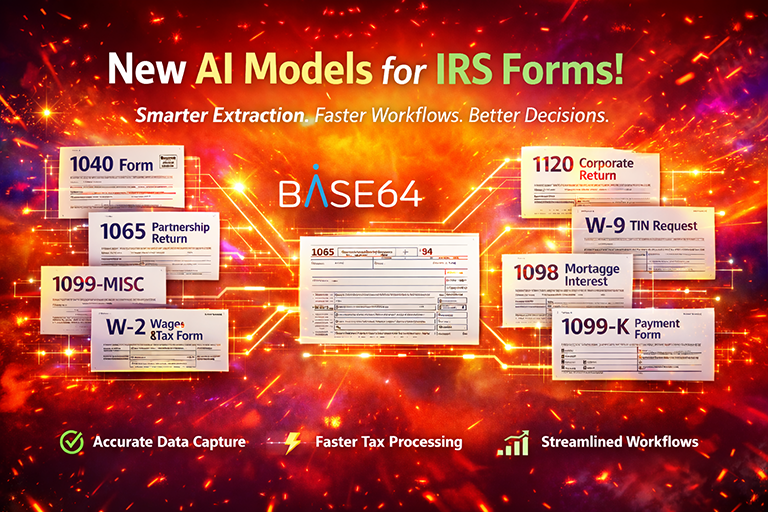

2,800+ pre-trained processing models including government IDs, bank cards, IRS forms, and more for industry-leading 99.7%+ data accuracy rates

More on pre-trained modelsUse 1 simple API call or hundreds of pre-built integrations to ingest documents and pass extracted data into your other systems

More on IntegrationsLeverage Base64 AI Agents to bring AI reasoning and decision-making into your workflow automations

More on AI AgentsPOPULAR USE CASES

Loan Origination & Processing

Automatically extract and validate data from loan applications, bank statements, tax returns, pay stubs, and other financial documents

AI document classification enables banks to process a wide variety of documents in a single workflow, ensuring faster approval times

AI agents can compare extracted data with internal guidelines to flag discrepancies, detect fraud, and assist in decision-making for loan approvals

Compliance & Regulatory Reporting

Automate compliance checks by extracting required data from KYC forms, risk assessments, and other regulatory documents

Built-in post-processing standardizes data into required formats for seamless integration into compliance reporting systems

IDP reduces manual review time and helps meet the stringent requirements of anti-money laundering (AML) and Know Your Customer (KYC) regulations

Onboarding &

KYC

Streamline identity verification by processing US & International IDs, passports, proof of address documents, and more, ensuring compliance with banking regulations

Document segmentation, shape verification, and classification allow banks to handle a wide array of documents in a single workflow

Facial recognition and signature match technology assist in identity verification and fraud detection, reducing onboarding time while ensuring security