January 21, 2025

In the rapidly evolving landscape of technology, businesses in banking and insurance are constantly searching for ways to enhance customer experiences, streamline processes, and stay ahead of the competition. One of the most exciting advancements in artificial intelligence (AI) is the rise of multimodal large language models (LLMs). While the term might sound complex, the concept is simple yet transformative. Let’s explore multimodal LLMs, how they work, and how they can empower operations teams in these sectors.

What is a Multimodal LLM?

A large language model (LLM) is an AI system that understands and generates human-like text. These models are trained on vast amounts of data, enabling them to answer questions, create content, analyze trends, and much more. A multimodal LLM goes a step further by integrating multiple input and output types beyond text. It can process and generate text, images, audio, and video information, collectively referred to as modalities.

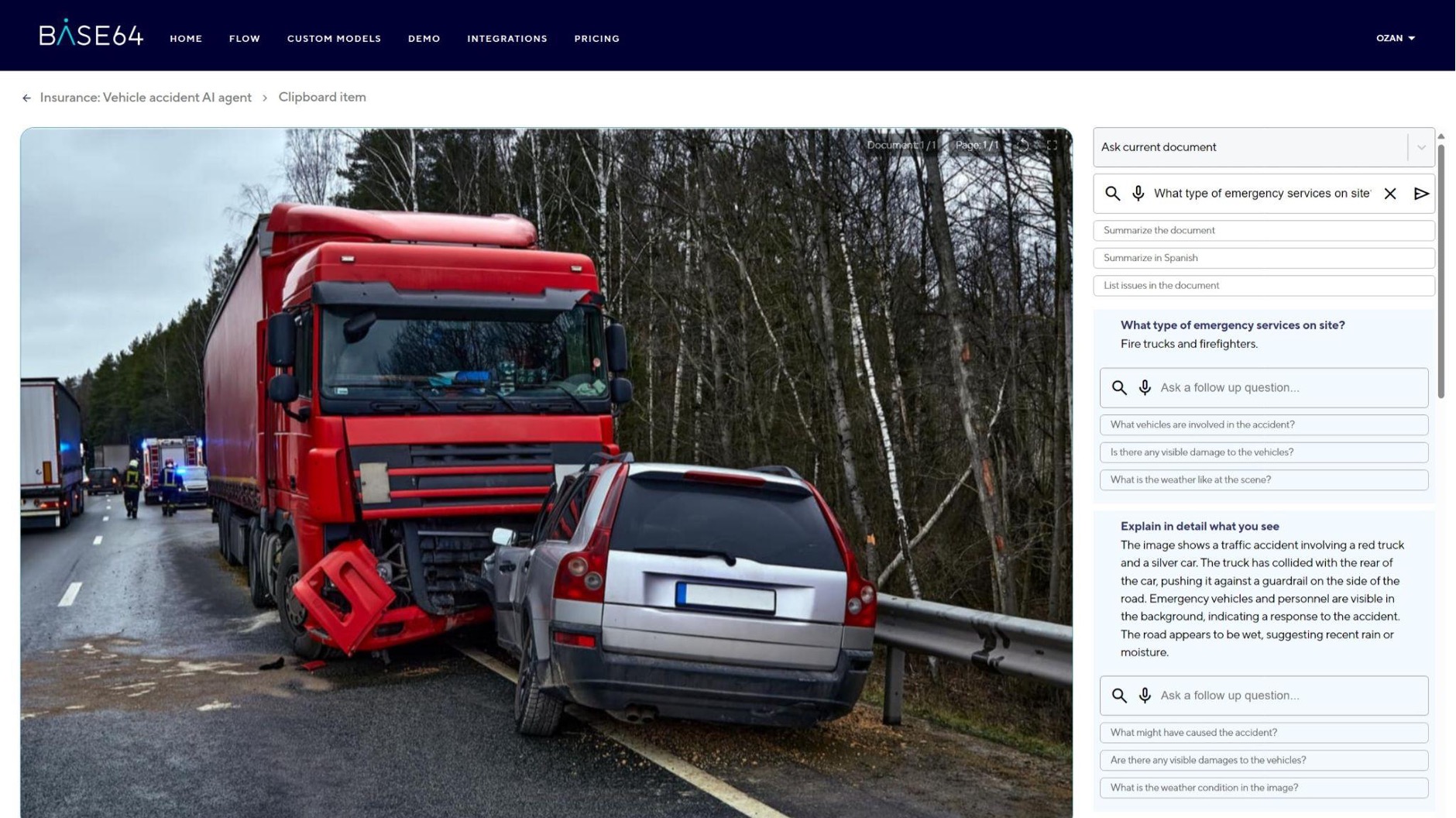

While LLMs can only understand text, Multimodal LLMs allow the AI to understand the world beyond text, just like humans do. It unlocks automation scenarios such as analyzing an accident photo, reviewing security video, and understanding a phone conversation. Multimodal LLMs break down communication silos between different data types, making it easier for operations teams to work more effectively.

How Does It Work?

Multimodal LLMs rely on deep learning techniques, a subset of AI that mimics the human brain’s workings. Here’s a simple breakdown of how they operate:

- Training on Diverse Data: These models are trained on massive datasets that include text, images, and sometimes audio or video. This diverse training enables them to understand and connect concepts across different formats.

- Unified Understanding: Multimodal LLMs can process multiple data types to understand the context more comprehensively. For instance, they can relate an image of a damaged car to policy terms and historical claims.

- Seamless Output: These models can generate outputs that combine or convert data formats once trained. For example, they can summarize a customer’s scanned documents in plain language or create a report based on text and images.

Why Should Operations Teams in Banking and Insurance Care?

- For operations teams, multimodal LLMs are a powerful tool for automating complex workflows and enhancing system capabilities.

- Faster Claims Processing: Multimodal LLMs can analyze photos of accidents or property damage, match them with policy documents, and suggest claim amounts in real time.

- Improved Compliance: These models can review scanned contracts, and regulatory documents to ensure compliance with minimal manual intervention.

- Enhanced Document Handling: Extract insights and automate data entry from scanned forms, invoices, or customer-provided images, significantly reducing processing times.

Transforming Customer Service

Operations teams often work closely with customer service to ensure smooth interactions. Multimodal LLMs can provide a significant boost:

- Interactive Support Tools: Customers can upload photos of IDs or forms, and the system can instantly verify and extract key data.

- Proactive Solutions: Analyze historical data, such as customer emails and images, to predict issues and suggest resolutions before they escalate.

- 24/7 Availability: Multimodal-enabled chatbots can process text and images, guiding customers through processes like filing claims or updating account details.

Real-World Applications in Banking and Insurance

Let’s bring it all together with a few practical examples:

- Fraud Detection: Analyze text and image data from claims to identify inconsistencies, or red flags, such as altered photos or mismatched descriptions.

- Loan Approvals: Process applications that include photos of assets and verify them against bank policies, speeding up approval times.

- Claims Assessment: Automatically evaluate damage from uploaded photos and compare it with historical claims data for faster payouts.

The Future of Banking and Insurance Operations

Multimodal LLMs represent a significant leap in AI’s ability to understand and generate data. Seamlessly connecting text, images, and other formats opens up new possibilities for operations teams to innovate, save time, and deliver exceptional customer experiences.

As businesses adopt this technology, the key is to start small. Identify specific pain points or goals, experiment with multimodal capabilities, and scale as you see results. With the right approach, multimodal LLMs can become a cornerstone of your strategy, driving growth and efficiency in ways we’re only beginning to imagine.