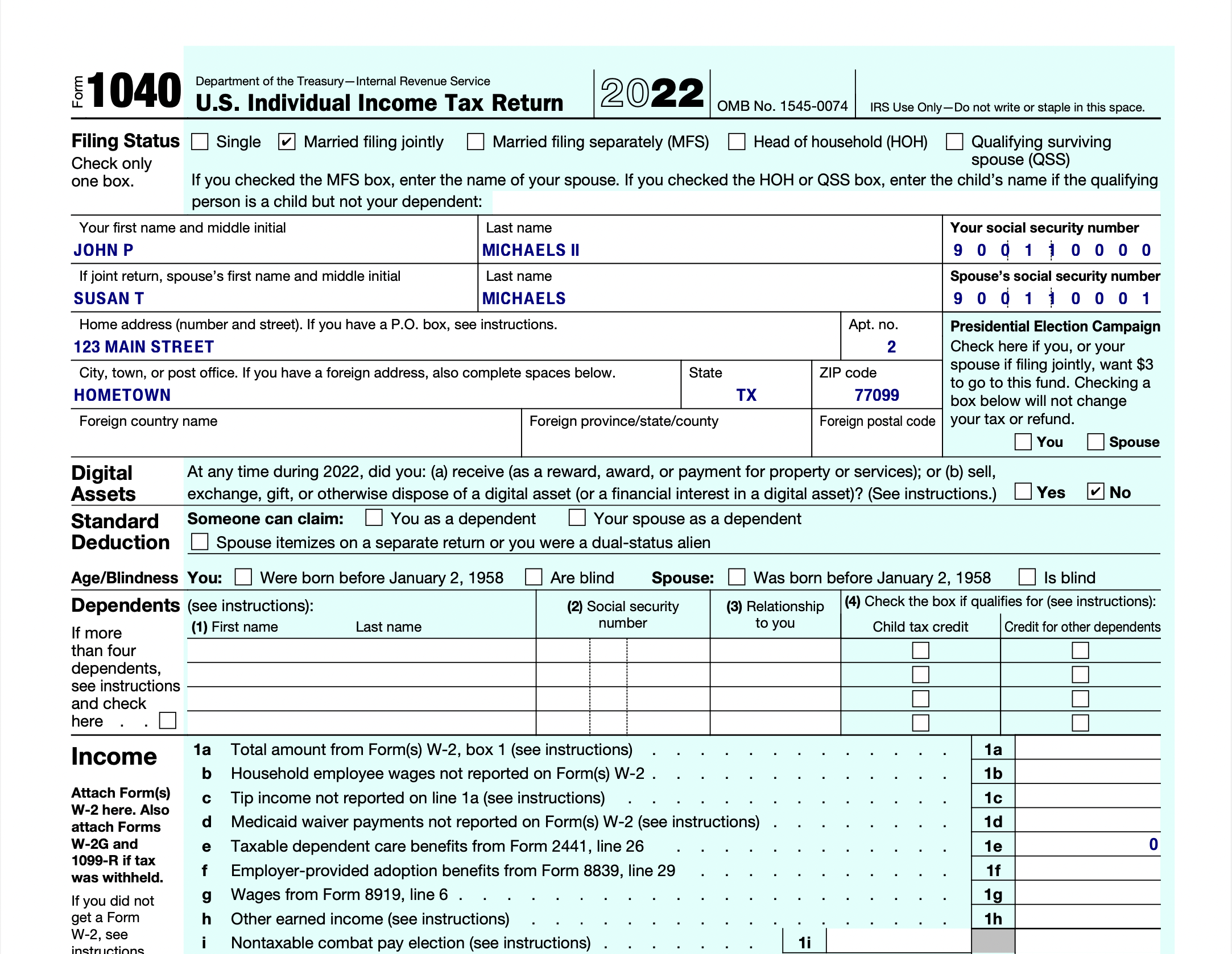

Extract Data From IRS Tax Forms

IRS tax forms are official documents from the U.S. Internal Revenue Service. They're used by individuals, businesses, and organizations to report income, deductions, credits, and financial info as required by the tax code. These forms cover various taxes like income, employment, estate, and gift tax, tailored to different taxpayers and activities, ensuring compliance and accurate tax calculation. Verify identity and finances using our IDP solution for 900+ IRS document versions, no extra training needed. See supported IRS documents in the Finance section of our Model Types page or click here.

JOHN P

The benefits of IRS Tax Forms document processing

Ensure that all relevant information is accurately extracted without skipping crucial information

Minimizing discrepancies from countless data points

Process sensitive data with a certified SOC 2 Type 2, HIPAA, and GDPR solution

Learn how innovative companies use our AI

Our customers save thousands of employee hours per month using our AI to process even the most complex documents in seconds with 99.7% accuracy.

READ CASE STUDIESOne product for all your data extraction needs

Pick a category to learn how we can automate your

Our AI service can scale infinitely in the cloud. No hardware

- IDs & Driver licenses

- Vehicle registrations

- Vehicle insurances

- Worldwide IDs

- Passports

- Travel visas

- Receipts

- Questions & Answers AI

- Invoices & Purchase order documents

- Checks

- ACORD Forms

- Summary of benefits & coverage

- License plates

- Shipping containers

- Files

- Forms

- Handwriting

- Mobile SDK

- Signatures

- Faces

- Human-In-the-Loop

- Checkboxes & Radio Buttons

- Multimedia

- Document Generation

- Shape Verification

- Photo Captioning

- Custom Taxonomy

- Text-to-Speech AI

- Speech-to-Text AI

- IBAN Detection

- IRS Tax Forms

- Address Geocoding

- Classification

- CMS 1500

- SMART Health Card

- Safety datasheets

- OSHA Forms

- Bill of Lading

- Customs declaration forms

- Semantic

- Documents

- No-code

- Digital Signatures

- Tables

- Checkboxes

- Entities

- Barcodes

- Watermarks

- Nixie labels

- Bank Cards

- US Green Cards

- US Social Security Cards

- Remittance

- Cloud Deployment

- Segmentation AI

- Image Quality AI

- Redaction AI

- Real ID and Enhanced ID